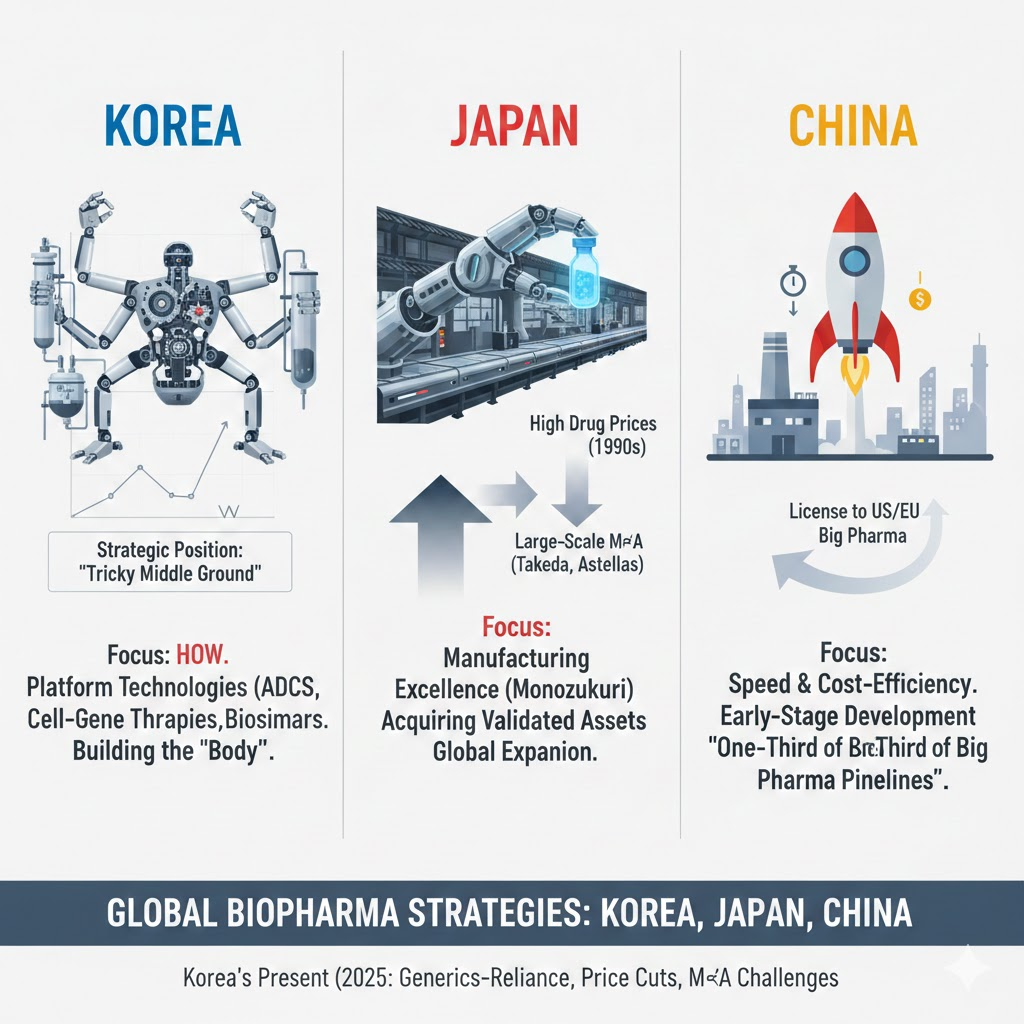

For professionals in the biopharmaceutical industry, choosing between Korea, Japan, and the United States involves balancing market scale, work culture, and long-term financial stability. While the U.S. offers the highest peak salaries, Japan provides unmatched stability and R&D investment, and Korea remains a competitive starting point despite having a smaller overall market.

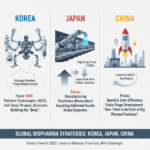

1. Market Scale and R&D Investment

The scale of the biopharma industry differs significantly across these three regions, which directly impacts career opportunities and research funding.

• Japan: The Japanese pharmaceutical market is the third largest in the world and approximately five times larger than South Korea’s. Individual “Big 5” companies like Takeda spend as much as 6 trillion KRW ($4.5B USD) annually on R&D, which is more than the combined R&D spending of over 200 Korean pharmaceutical firms.

• Korea: While successful firms like Samsung Biologics and Celltrion exist, the industry often focuses more on how to build a pipeline (process) rather than the why (fundamental disease research).

• United States: The U.S. remains the global hub for innovation, particularly for those pursuing “Blockbuster” drugs—medications that generate over $1 billion in annual revenue.

2. Work Culture and Environment

Each country offers a distinct professional atmosphere, ranging from high-pressure execution to long-term consensus-building.

• Korea: Known for intense pressure and short deadlines. Projects that might take a year in Japan are often expected to be completed in three months in Korea.

• Japan: Emphasizes long-term stability and thoroughness. It is common for employees to stay at a single company for over 30 years until retirement at 60. Work involves lengthy “internal persuasion” periods; for example, selecting a single reagent can involve three months of discussion. Additionally, Japan utilizes dispatch (haken) workers for routine tasks, allowing regular researchers to focus purely on management and R&D.

• United States: Focuses on high-level expertise and individual performance. It is a target for those who want to work at the executive or principal scientist level within global Big Pharma.

3. Salary and Compensation

The financial rewards vary based on tenure, degree, and the local cost of living.

| Feature | South Korea (Only Big Company) | Japan (Big 5) | United States |

|---|---|---|---|

| Typical Target Salary | High starting pay in large firms; low in ventures. | 10M+ JPY (~$75k USD) for high-earning experts. | $200k+ USD (Base) for Principal Scientists. |

| Growth Potential | Limited by tenure and smaller market size. | Stable growth; 15-year average tenure. | Highest ceiling; includes equity/stocks. |

| Housing Benefits | Generally not included in base salary. | Often provides Shataku (company housing). | High living costs; family expenses can exceed $6k/month. |

4. Career Paths and Immigration

For researchers, the Ph.D. degree is a critical asset for international mobility.

• The U.S. Route (NIW): Many professionals utilize the National Interest Waiver (NIW) to obtain a Green Card without a specific job offer, based on their research achievements. Success often requires a high-quality Principal Scientist or Associate Director profile.

• The Japan Route: A Ph.D. from a reputable Japanese university is highly regarded and helps overcome the “foreigner risk”. High-earning foreign professionals in Japan (earning 10M JPY+) can even qualify for “Full Loans” to purchase property.

• Korean Bio-Ventures: These are often viewed as a “last resort” due to lower pay, unstable employment, and a lack of systematic career development compared to large corporations.

5. Essential Success Factors for Global Moving

Communication is King: In any interview, from Tokyo to Boston, your ability to prove you are a collaborative teammate is more important than your specific lab techniques.

Strategic Negotiation: When moving countries, always negotiate for relocation costs, visa fees, and housing allowances.

Local Integration: If targeting Japan, showing a strong intent to stay long-term and learning the language is critical to overcoming the “foreign risk” perception.

The global biopharmaceutical industry is a high-stakes arena where the right degree and the right location can set you up for life. Whether you choose the stability of a Japanese “Big 5” firm or the high-growth potential of a U.S. biotech, your professional narrative—built on expertise and interpersonal skill—is your most valuable asset.

6. Comparing the Giants: 10M JPY (Japan) vs. $200k (USA)

When looking at top-tier compensation, it is important to understand what these figures represent in their respective societies.

• Japan (approx. $75k – $80k USD):

◦ Social Standing: This puts you in the top 5% of earners in Japan.

◦ Financial Benefits: It grants high social credit, often enabling “Full Loans” (100% financing) for property purchases even for foreigners.

◦ Hidden Value: Many Japanese firms provide a Shataku (company housing) benefit, which significantly offsets the high cost of living in hubs like Tokyo.

• USA (approx. $200k USD):

◦ Target Roles: This is the standard base salary for Principal Scientists or Associate Directors with several years of industrial experience.

◦ Social Standing: This typically represents the top 5-10% of individual earners in the U.S.

◦ Considerations: While the gross amount is higher, individuals must account for high healthcare costs, varied state taxes, and the absence of the subsidized housing common in Japan.

![[Ultimate Guide] Re-entry Permit Strategy: Filing in Boston & Biometrics in Saipan](https://inter-style.net/wp-content/uploads/2026/01/image-150x150.png)