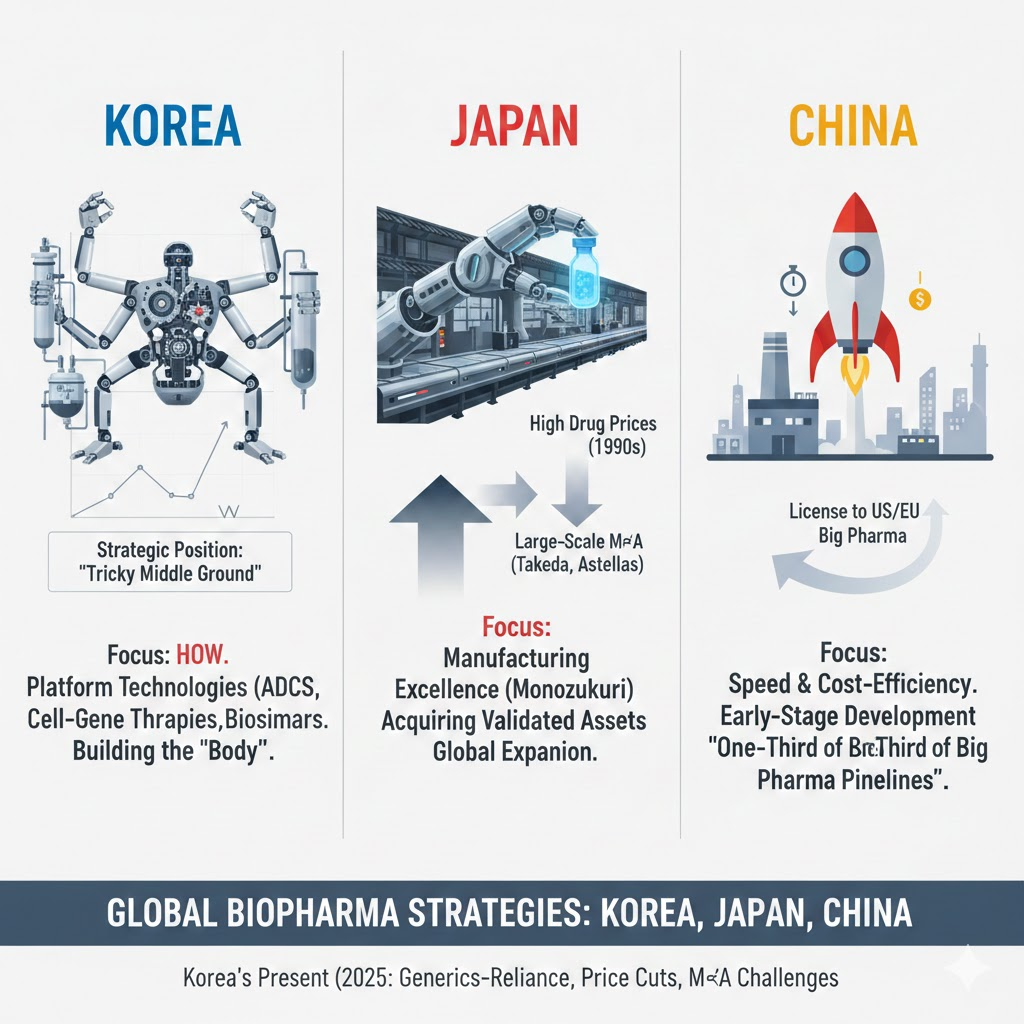

For high-earning foreign professionals in Japan, such as those earning 10M JPY or more, the path to a mortgage is highly favorable but requires specific strategic maneuvers—especially regarding the one-year tenure rule and the use of a guarantor and permeant residency to unlock 100% financing.

Loan Capacity and the “Full Loan”

For an individual earning 10 million JPY annually, Japanese banks typically offer a loan amount of 7 to 8 times your annual income, which translates to roughly 70 million to 80 million JPY.

How a “Full Loan” Works: Normally, foreign residents are restricted to a limit of 80% of the property’s value. To achieve a Full Loan (100% or even 100% + expenses), the following conditions generally apply:

• The Justification: A “Full Loan” is granted to cover not just the purchase price, but also taxes and miscellaneous acquisition fees (such as stamp duty, registration tax, and brokerage fees).

• The Key Requirement: You must have a Japanese spouse act as a guarantor. Even if the spouse has no income, their status as a Japanese national provides the bank with “social credibility” and a higher probability that you will remain in or maintain ties to Japan. And A permeant resident card is another key factor for making full loan.

Strategic Guide for Foreign Professionals in Japan

1. The “One-Year” Tenure Hurdle

Even with a high salary, most major banks (like SMBC Prestia) require you to have worked at your current company for at least one year.

2. Property Selection (The 1981 Rule)

Banks prioritize the collateral value of the building.

• The Trap: Avoid “Old Earthquake Standard” buildings constructed before 1981.

• The Goal: Focus on properties built within the last 10 years in high-demand areas to ensure smooth appraisal and higher resale value.

3. Handling Overseas Relocation

Standard residential loans are for those intending to live in the home. If a global transfer occurs after the loan is started, banks often handle this as a “maintenance case”. You must maintain communication, update your address to a domestic contact (like your mother-in-law’s home), and ensure the bank knows you intend to return or maintain the asset.

——————————————————————————–

The “Hojin” (Asset Management) Advantage

If you plan to live in the U.S. while keeping the property, establishing a Family Asset Management Company is the most tax-efficient move.

• Avoid Withholding Tax: Non-resident individuals face a 20.42% withholding tax on rent and 10.21% on sales. A Japanese company is a “domestic resident,” exempting it from these heavy penalties.

• Income Splitting: You can appoint family members as directors and pay them a board member’s salary, which distributes income and reduces the overall tax burden through the employment income deduction.

• Lower Tax Rates: For small corporations (capital under 100M JPY), the tax rate for the first 8M JPY of annual income is significantly lower (approx. 15%) compared to high personal income tax rates.

• Expense Deductions: A company can deduct depreciation, repair costs, management fees, and insurance as business expenses, which is much more flexible than personal ownership.

![[Ultimate Guide] Re-entry Permit Strategy: Filing in Boston & Biometrics in Saipan](https://inter-style.net/wp-content/uploads/2026/01/image-150x150.png)